In this report, we dig in on the Rockies / Bakken region, which has been much firmer this quarter (after a very soft Q3)...

About

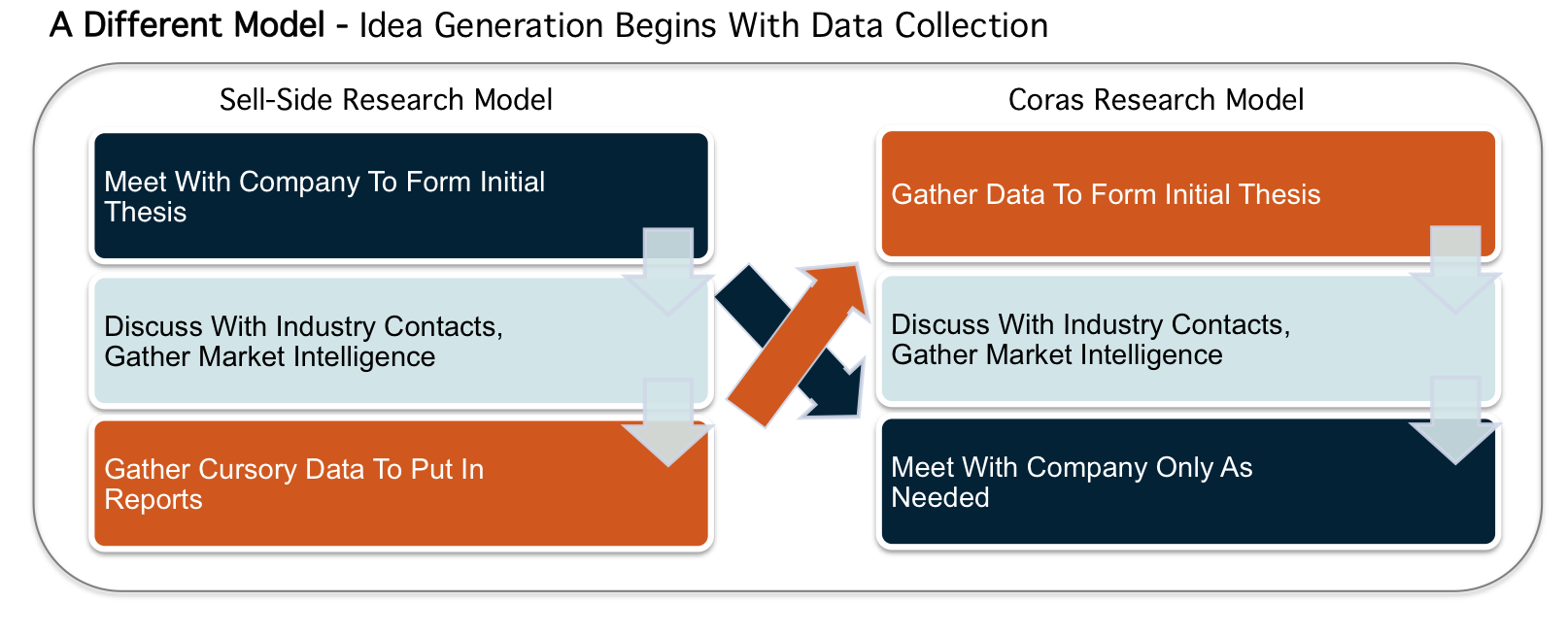

Coras Research is an independent research firm that leverages a large oil service database to provide high-quality research to institutional subscribers. The firm is not a broker-dealer nor do we advise on mergers & acquisitions, bring companies public, or facilitate management access of covered companies – all of which contributes to our objectivity when making critical decisions about the companies we cover.

While investors have an abundance of ‘free research’ from broker-dealers, our product relies solely on the quality of our research to attract users. With that in mind, Coras Research has developed a differentiated approach to idea generation that begins with the industry’s most comprehensive set of data. Our view is that Energy and Oil Service investors still rely too heavily on anecdotes and industry commentary rather than leveraging the ‘Big Data’ now available in oil & gas.

![]() Coras was started in 2015 by Daniel Cruise, a 10 year veteran in Energy and Oilfield Services, whose most recent experience was publishing North America focused research for Wells Fargo Securities. The goal at Coras Research is to provide the link between a growing amount of oil service data and industry/company expectations.

Coras was started in 2015 by Daniel Cruise, a 10 year veteran in Energy and Oilfield Services, whose most recent experience was publishing North America focused research for Wells Fargo Securities. The goal at Coras Research is to provide the link between a growing amount of oil service data and industry/company expectations.

-

Large database of oil service metrics updated realtime

-

Independent from broker-dealer or investment bank with flexibility for bespoke assignments

-

De-emphasis on anecdotes and company commentary

-

Encrypted distribution to subscribers

- 18 Dec 2020

After lagging the initial frac count surge, rig deployments are poised to meaningfully outperform in coming months. The ...

24 Nov 2020

founder

Daniel cruise

Coras Research was founded by Daniel Cruise as an alternative approach to the well covered broker-dealer model. He has over ten years of energy and oilfield services experience working in both buyside and sellside equity analyst roles, including positions at Jefferies, Evercore-ISI, and Wells Fargo Securities. Daniel is a Texas A&M University alumni with degrees in both accounting and finance.